Unlocking Financial Empowerment: The Rise of Cryptocurrency in Africa

Introduction

The African cryptocurrency market is undergoing a remarkable transformation, redefining the financial landscape in ways previously unimaginable. In this article, we delve into the aspects of this evolution, exploring how cryptocurrencies have emerged as an alternative financial system, the challenges traditional financial systems face in Africa, and the role of cutting-edge technologies and the youth population in driving this revolution.

Cryptocurrency as an Alternative Financial System

Cryptocurrencies are gaining traction as an alternative to traditional financial systems across Africa. Their appeal lies in their accessibility, efficiency, and reduced reliance on conventional banking infrastructure. In a continent where access to financial services can be limited, cryptocurrencies offer a lifeline to financial inclusion, allowing individuals to participate in the global economy like never before.

Accessibility is a key factor. In many African countries, traditional banking services are scarce, particularly in rural areas. Even in urban centers, the banking infrastructure can be inadequate. Cryptocurrencies transcend these limitations, requiring only an internet connection, which is becoming increasingly widespread in Africa.

Efficiency is another critical element. Traditional banking transactions can be slow and expensive. Cryptocurrencies enable near-instantaneous global transactions at a fraction of the cost, which is especially beneficial for international trade and remittances. Moreover, cryptocurrencies reduce reliance on traditional banking infrastructure, which can be fragile and prone to disruptions. In regions with political or economic instability, this independence from centralized financial systems is especially valuable.

Challenges of Traditional Financial Systems in Africa

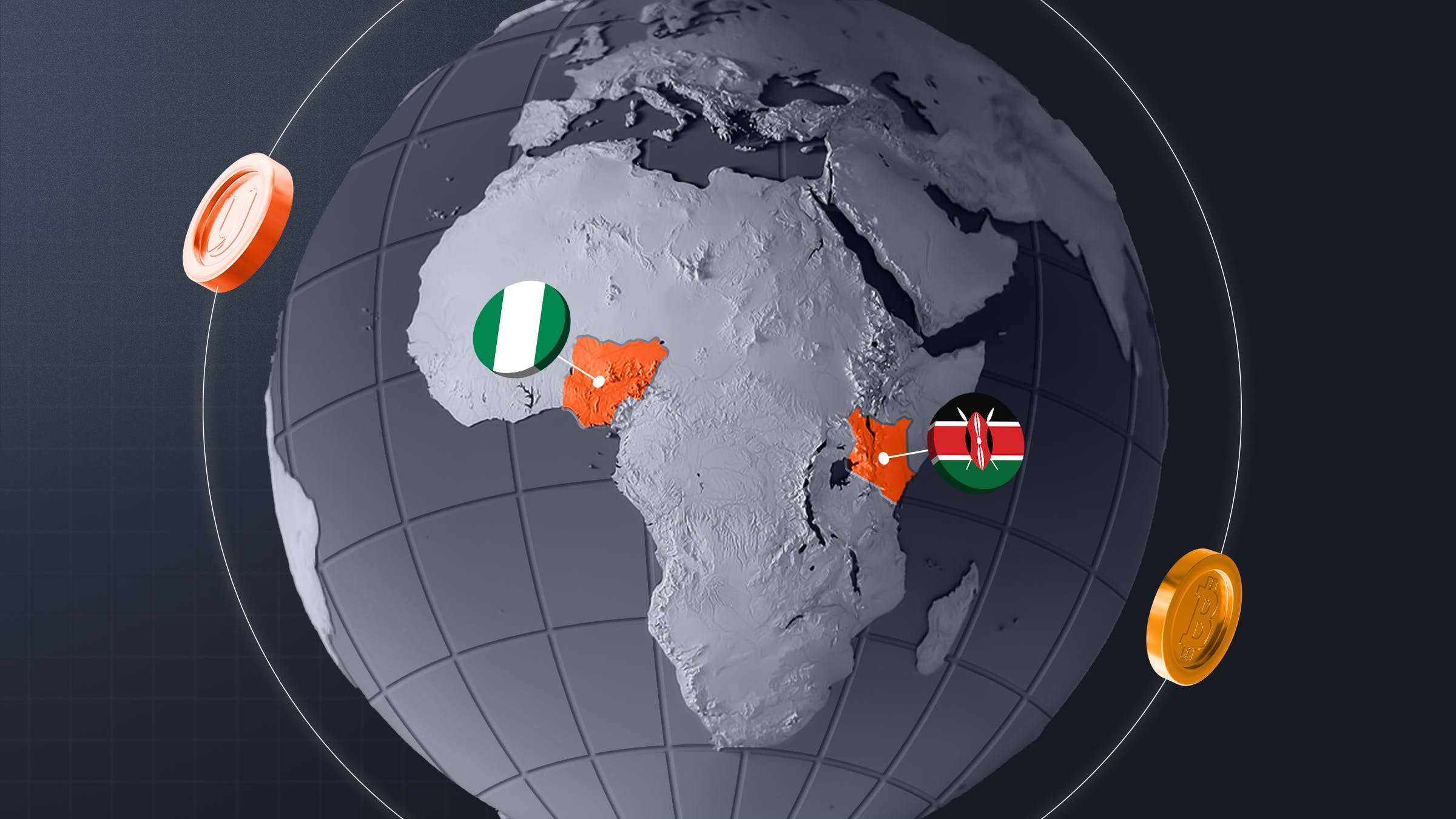

Traditional financial systems in Africa, particularly in countries like Nigeria and Kenya, grapple with numerous challenges. Limited access to banking services is a relevant issue. According to the World Bank, a significant portion of the African population remains unbanked, depriving individuals of basic financial services, such as savings accounts and credit.

High fees are another pain point. Traditional banks often charge substantial fees for even the most basic transactions, eroding a significant portion of an individual's income. Currency instability is a major concern, particularly in countries with volatile fiat currencies. Cryptocurrencies, notably Bitcoin, have been viewed as a reliable store of value in such situations, providing a means of safeguarding wealth.

Nigeria and Kenya's Tech-Savvy Population and Youth Demographics

The youth populations of Nigeria and Kenya have played pivotal roles in driving the widespread adoption of digital technologies, including cryptocurrencies. Their familiarity with digital platforms and a hunger for financial inclusion and empowerment have been driving forces behind the crypto revolution.

Nigeria boasts a large and tech-savvy youth demographic, with over half of its population under 25. This digitally native cohort is comfortable with technology and eager to explore new financial avenues. In Kenya, the tech-savvy youth have embraced cryptocurrencies. The country's thriving tech scene and entrepreneurial spirit have created productive ground for cryptocurrency startups and adoption.

Overview: Nigeria's Cryptocurrency Adoption

Nigeria's cryptocurrency adoption story is particularly compelling, with peer-to-peer (P2P) trading platforms at its core. These platforms facilitate cryptocurrency adoption, especially in regions with limited access to formal financial systems. They empower individuals to exchange digital assets directly, fostering financial independence. P2P trading platforms connect buyers and sellers directly, eliminating the need for intermediaries like banks. This democratizes access to cryptocurrencies, allowing individuals to acquire digital assets with their local fiat currencies.

In Nigeria, platforms like LocalBitcoins and Paxful have gained immense popularity. They provide a safe and convenient way for Nigerians to buy and sell cryptocurrencies, even specifying preferred payment methods. This P2P model empowers users to make transactions on their terms, particularly valuable in regions with diverse financial needs and preferences.

Cryptocurrency adoption in Nigeria has been driven by the need for financial empowerment and inclusion. Traditional banking services often exclude large segments of the population, leaving many Nigerians without basic financial services like savings accounts and credit.

Cryptocurrency as a Hedge Against Inflation

Cryptocurrencies have proven to be a reliable hedge against inflation and currency devaluation in economies prone to such fluctuations. Traditional currencies' loss of value can erode savings and disrupt economic stability, making cryptocurrencies an attractive option. Nigeria, in particular, has faced issues related to inflation and currency depreciation. Cryptocurrencies, notably Bitcoin, have gained popularity as a store of value, protecting savings from the effects of inflation.

Remittances and Cross-Border Transactions

The crypto revolution has streamlined cross-border transactions and remittances in Africa. With cryptocurrencies, individuals can send funds across borders faster and at a lower cost than traditional methods. This is particularly significant for a continent with a large diaspora and substantial international trade.

Traditional remittance services can be costly and slow, involving multiple intermediaries. Cryptocurrencies enable near-instantaneous, peer-to-peer transfers, benefiting both senders and recipients. Moreover, cryptocurrencies facilitate international trade, allowing African businesses to engage globally with ease by accepting cryptocurrency payments.

Continued Growth and Collaboration

The trajectory of cryptocurrency integration in Nigeria and Kenya is one of continuous growth, sustained by collaboration between innovative technology providers, financial institutions, and regulators. The dynamic nature of this process requires stakeholders to adapt and engage actively, fostering an ecosystem conducive to innovation and progress.

In Nigeria, cryptocurrency startups provide a range of services, from trading platforms to payment solutions, driving adoption and awareness. Financial institutions are exploring ways to integrate cryptocurrencies into their offerings, allowing customers to buy and hold cryptocurrencies through their accounts. Regulators in Nigeria and Kenya are providing clarity and oversight in the cryptocurrency space, recognizing its potential benefits while protecting consumers and fostering innovation.

How Unido can help drive financial inclusion in Africa

Unido can be a leading force in promoting financial inclusion across Africa, utilizing blockchain and cryptocurrency technologies to empower individuals and businesses. The platform provides accessible and secure financial services, regardless of geographical or economic constraints. With a focus on empowering financial inclusion, Unido stands as a catalyst for transformation across the continent, ensuring that everyone can participate in the global economy.

Unido offers a comprehensive solution for seamlessly managing and safeguarding digital assets. At its core lies the patented Multi-Party Computation (MPC) technology, ensuring robust security. This advanced cryptographic protocol disperses private key components among multiple stakeholders, enabling secure collaboration without compromising confidentiality. Unido's versatility caters to individuals, families, and enterprises, with multi-signature capabilities fortifying digital asset security. Our platform also connects users to various DeFi platforms, offering access to multiple blockchains and enhancing financial opportunities. Additionally, through the Unido app, users can purchase over 100 cryptocurrencies in 125+ countries, providing global accessibility and expanding financial options.

Unido is not just a platform but a transformative solution, aligning with the aspirations of Africans for financial empowerment. As Africa embraces cryptocurrencies and blockchain technologies, Unido is committed to supporting this shift and enabling users to take control of their financial futures.

===

Unido enables individuals and enterprises (SMEs and beyond) to seamlessly manage their crypto assets and invest into DeFi Markets, by providing an enterprise grade platform with DeFi and crypto banking management tools.

For more about Unido including enterprise-level solutions and latest updates visit the Unido website.

The Unido Enterprise Platform:

- World Class Security

- Multi-user, Multi-signature

- Analytics and Reporting

- Interoperability and Multichain

- Decentralized Self-Custody

Read more about Unido Enterprise Platform

Read more about $UDO token

Read more about Previous Article

Connect on Telegram or Discord

Stay up to date with our Blog