Unido’s Approach to Ecosystem Development

A healthy and fully-featured ecosystem of applications is an essential part of any network. It’s what makes its services greater than the sum of their parts and creates a valuable user experience for all. Ultimately, it drives adoption.

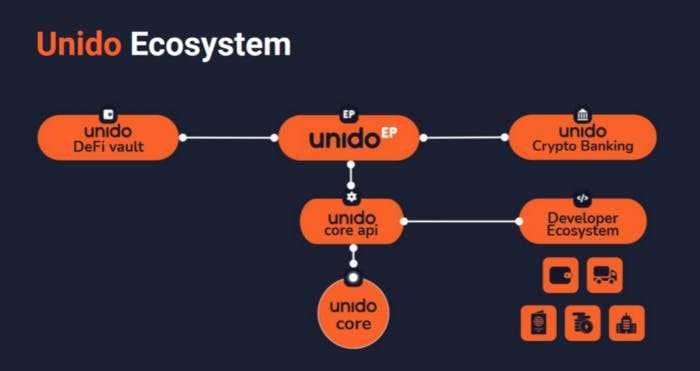

The Unido team is focused on the development of a comprehensive ecosystem of services based on the Unido Core API. It supports third-party applications that further Unido’s capabilities for banking, fintech, payment gateways, asset management, insurance, exchanges, governance, and SMEs.

To foster these initiatives, Unido counts on a multi-pronged approach:

Ecosystem Development Fund

A perpetual ecosystem fund dedicated to subsidizing & incentivizing third-party projects looking to build new decentralized applications on Unido Core. This provides them with scaling resources and access to enterprise grade solutions through the Unido Core API and SDKs which can be leveraged by independ teams across a wide variety of use cases.

These tools help expand Unido’s offerings and meet the needs of particular users who might benefit from special use cases. In this way, Unido’s services can be customized in a decentralized manner.

DAO

To guarantee the decentralization of the ecosystem, the resources in the Ecosystem Development Fund are managed by a decentralized autonomous organization (DAO). This is basically a set of smart contracts that guarantee funds are deployed in accordance with what is pre-established by the governance committee at protocol level, not according to any singular participant in the network. The DAO is run by a governance committee that uses a democratic voting system to decide on which proposals to approve and dedicate funds to from the EDF.

UDO Token

The whole Unido ecosystem runs on the native UDO token. The UDO token provides users with access to the products/services in the Unido ecosystem, including the decentralized apps built by third-parties for the network. It is also used for payment services between network participants and it grants voting rights to its holders for key governance decisions made on the platform.

Liquidity Mining and Treasury

Much like popular programs on DeFi protocols, Unido’s take on liquidity mining distributes the UDO token to early adopters. This incentivizes users to keep the ecosystem solvent.

Unido has also implemented a Treasury where UDO transactions are handled in the back end of the platform. This allows users who prefer to transact in stablecoins to do so seamlessly as the system is able to do automatic exchanges between these and UDO tokens.

Altogether, these key characteristics of the Unido network guarantee the development of a decentralized and ever-growing platform. One where developers are not only free to create the tools that are needed for any user, but also one where they have the necessary resources to do so.

By providing decentralised governance through the DAO and financial support through the EDF, Unido lays the foundations for third-party to build on top of the Unido Core technology. On the other hand, the UDO token, Liquidity Mining Program, and Treasury ensure that the applications that are developed on the platform provide a seamless user experience and are capable of sustainable scaling as adoption increases whilst retaining the UDO token at the heart of every transaction.

About Unido

Unido is an enterprise platform for decentralized capital markets. It enables institutions & corporate clients to securely store, manage and invest their crypto assets into decentralized finance networks. Unido is underpinned by proprietary key signing technology that provides enterprise-grade security for any transaction which utilizes it.

Founded in 2017 and with a market-ready product, Unido is led by an experienced team of ex-Goldman Sachs, ex-Macquarie and ex-Wipro with decades of experience in enterprise software development, financial services and agency blockchain development.