How Unido stacks up against Qredo

With the competition for enterprise-level crypto solutions growing, our community members often ask how we stack up against other projects in the space. There is huge value in looking at what sets different technology solutions apart and one project our community has asked about is Qredo.

Enterprise-grade solution ecosystem aimed at institutions and small and medium enterprises (SMEs) looking to capitalise on cryptocurrency is growing exponentially these days. Qredo is one of the newest direct competitors to offer a robust product for institutions entering the crypto space.

What is Qredo?

Qredo is a decentralized asset management infrastructure solution. It has a layer-2 blockchain protocol for fast transactions and a product suite designed for institutional investors.

The Qredo protocol enables you to easily transfer and settle Bitcoin, Ethereum, and ERC-20 token trade with governance structures in place, and features Multi-Party Computation (MPC) for security, similar to Unido.

Much like Unido, they are an on-ramp for enterprises and institutions to invest in Defi and a protocol to securely manage crypto banking operations in one place.

While, on the surface, it appears that both projects have similar products and offerings, there are differences in how both achieve security, ease-of-use and software architecture and design.

MPC is not MPC

The main differentiator is that Unido is not a Layer-2 blockchain solution but rather a technology ecosystem that addresses governance, features user-friendly workflows and a patent-pending MPC algorithm for bank-grade digital asset security.

While Qredo implements its multi-party computation (MPC) on a Layer-2 network, Unido’s MPC is embedded in our app framework, Unido Core, which powers all of our applications.

At the heart of UnidoEP is a patent-pending, proprietary algorithm that fragments the private key into several shards and stores them securely amongst various members/devices or automated systems.

On the other hand, Qredo’s MPC is trustless. Multiple parties or key holders can coordinate using a blockchain consensus over a blockchain network. One key controls the digital assets that generate 'independent secrets.' These are spread to various MPC nodes at tier 4 data centers, ie. centralized key fragment hosting.

API Access

Qredo allows development on their network blockchain network via two distinct but common protocols synced and cryptographically bound to enable encryption, authentication, non-repudiation of digital signatures, and verification in different blockchain layers on their protocol.

Unido Core allows third-party developers to connect and build new products on top of the technology stack. The API enables developers to build blockchain dApps, with a turnkey solution to the challenges of security, governance, and accessibility.

Unido Core Offerings

Unido offers a robust product for governance, compliance and treasury management. The Unido Enterprise platform, or EP for short, enables crypto-native small and medium enterprises (SMEs) and asset management firms to manage and invest their crypto and digital assets quickly and seamlessly. Unido does this by providing an extensive suite of crypto banking services, with trading and payment that can be easily accessed via our enterprise dashboard.

Unido Insto, another core product, allows any enterprise or institution to create a "white label" version of the software to be used for their business. Insto offers extensive configurations, interoperability and presentation options, and it is secured by patented multisig key management technology. Unido Insto provides a complete set of the fully composable, enterprise-grade trading interface, security management, and corporate governance of crypto assets owned by banks, institutional investors, crypto-native organizations, and exchanges.

Another similar product offering is Qredo's Signing app, which is comparable to the Unido X product. The Qredo signing app is a Layer 2 P2P trading network that enables clients to have instant cross-chain atomic swaps, and ultimately provides institutional-grade security for their digital assets. The app also has other vital functions like logging into the Qredo Network, authorization and approval of addresses and to authorize a custodian to approve transactions.

Same, same but different

Qredo uses a vastly different approach to Multi-Party Computation and refers to their network as a 'Vault,' essentially leveraging their MPC across a blockchain network to create what they call 'decentralized custody.'

On the other hand, Unido keeps the MPC algorithm inside the software dashboard and wallet, keeps seed phrases clear and never exposed. One product is not necessarily better than the other. They are just different and it’s up to our customers to decide which type of solution suits their needs.

Tokenomics

Qredo's native token, $QRDO, is a utility and governance token for the Qredo Network, and incentivizes its ecosystem from validators, liquidity providers, traders and those who use custody on their network.

Unido’s native token, $UDO, does all of this as well and powers the ecosystem, providing untethered access to dApps. $UDO also grants users voting rights in a future DAO system and rewards people for participating in the ecosystem.

Both applications have a strong use case to meet future demand for enterprise-level decentralized finance and crypto custody solutions. For token holders, however, the primary point of difference is in the token price.

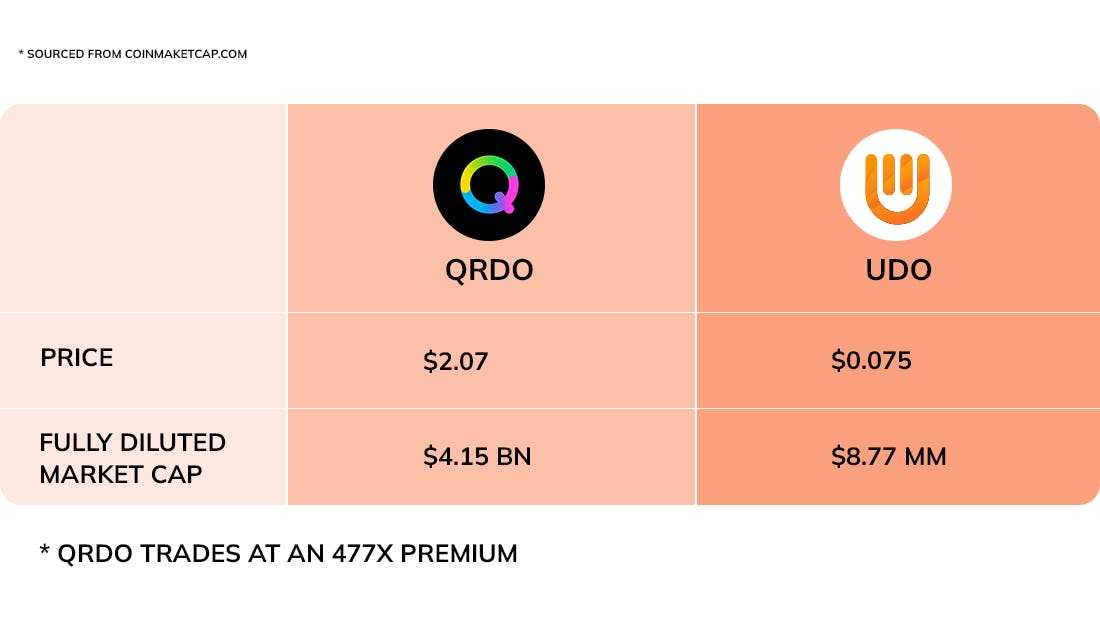

At the time of writing, $QRDO tokens are currently priced at $2.07 per token (see table below for details), whereas $UDO is currently priced at $0.075.

Our take on the token valuation is that both Qredo and Unido are operating within a growth industry--enterprise crypto custody solutions, so both could offer a valuable opportunity for savvy crypto investors.

Qredo or Unido or both: You choose

While both of Unido’s and Qredo’s core offerings might overlap in what they are trying to achieve, their technology varies greatly.

There’s no doubt Qredo is a significant competitor with very similar core product offerings to Unido. From taking on governance and giving enterprises liquidity, both protocols offer excellent products that many enterprises will consider.

About Unido

Unido offers a suite of crypto custody solutions for enterprises and institutions based on a state-of-the-art fragmented private key signing engine, allowing distributed transaction signing at the blockchain level and providing a corporate governance framework over crypto ownership.

This level of corporate governance workflow and security technology is needed by sophisticated organizations to confidently leap into crypto, augmented with a Defi investing dashboard to make earning a yield on digital assets a point-and-click activity.