Unido App — A DeFi Staking Aggregator Crypto Investors Need

DeFi — Opportunities and Challenges

With the growth of the decentralized finance (DeFi) space, users (including enterprise clients, small businesses, and private, retail investors) now have more options than ever for investing in income- and token-generating DeFi products. From liquidity pools to crypto loans and everything in between, these effective, battle-tested investment vehicles are revolutionizing the world of finance.

One major issue for investors, however, is determining the optimal investment opportunity from countless available options. This is where yield aggregators come in. Another major issue is enjoying easy, intuitive access to these opportunities. This is where the Unido App comes in. We talk about yield aggregators and the Unido App below.

The Importance of Yield Aggregation

First, let’s discuss the importance of yield aggregators.

Yield aggregators are designed to optimize the deployment of digital tokens or assets in different DeFi investments. These aggregators use compounding, pooling of gas fees, and other automated strategies such as determining the optimal time and amount for making specific trades or allocations to help investors save time and money and earn the highest returns on their investments.

Unido has created a highly performant suite of financial products (including a yield aggregator and a custom app, which we discuss below) that are built for the rapidly changing DeFi world. Unido acts as a bridge between centralized and decentralized finance, and it helps not only enterprise concerns but small businesses and individuals access a wide range of crypto- and blockchain-based investment opportunities.

Staking and Liquidity Pooling

Staking and liquidity pooling are two remarkable examples of how DeFi is changing how people think about finance.

In staking, an investor deposits a certain amount of a certain token, for example, ETH, into a pool, generating APY returns based on how long the tokens are staked for. Instead of leaving available ETH tokens idle, yield aggregators can be used to identify the best staking pool available to automatically allocate idle tokens to that pool.

In liquidity pooling, investors deposit equal amounts of two tokens in a pair, such as ETH-UDO, into a pool. The bigger the pool, the higher the liquidity available in the market. Other traders in the market can then buy and sell those tokens from the balance available in the pool. As a reward for providing this liquidity, investors are given a share of the commissions earned from trades executed using tokens from the pool in question.

Liquidity pooling has the additional benefit of allowing investors to convert commissions into a base token such as ETH or UDO and then reinvest those tokens automatically into a pool. This creates a virtuous cycle of earning commissions, converting commissions to tokens, reinvesting those tokens, and earning more tokens, and so on. This is particularly beneficial in bear markets when it is harder to earn capital gains on tokens that are falling in price and investors must instead resort to innovative new uses for their assets.

Read more — The Complete Guide to Holding Unido (UDO) Tokens and Earning Rewards

The Unido App and Yield Aggregator

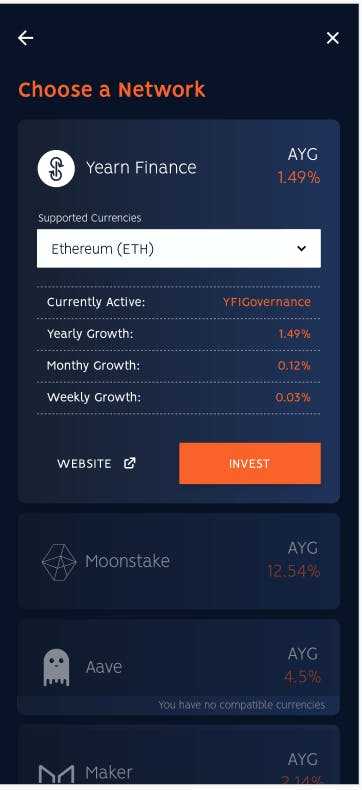

The Unido App aggregates investment opportunities from multiple platforms, including yearn.finance and Aave, all on a single app. Users no longer have to jump from platform to platform or from app to app to avail the best investment opportunity available in the market.

Unido Partnerships

To grow the Unido partner network, Unido has joined forces with Moonstake — the first staking platform to integrate with the Unido ecosystem. Moonstake holds over $800 million in staked assets and owns a proprietary staking protocol that Moonstake is using to become the largest staking pool network in Asia. Unido is spearheading the development of the entire solution and is providing engineering support to Moonstake for their Tezos staking pools.

By integrating with Moonstake, Unido users will have access to Moonstake’s staking pools, and Moonstake users will be able to access Unido’s many DeFi products and solutions. These include Unido Enterprise Platform (EP) and Unido Institutional, as well as asset collateralization services, portfolio diversification services, and asset and loan management tools — all with Unido’s proprietary, enterprise-grade key fragmentation security protocols.

Read more — Unido and Moonstake Partnership — What’s Coming From The Collaboration?

Glimpse of the UnidoApp

Here’s a small sneak peak for you of what we are building and what the steps on our app look like.

Here is the intro screen to the app which will allow you to choose your staking platform and choose the cryptocurrency of your choice.

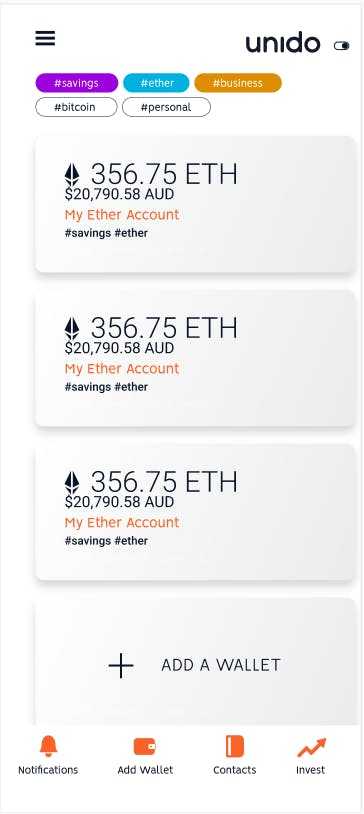

The app screens are available in both ‘light’ and ‘dark’ mode. Our wallets will support more than 300+ active cryptocurrencies and you will be able to store as well as stake them via our staking aggregator.

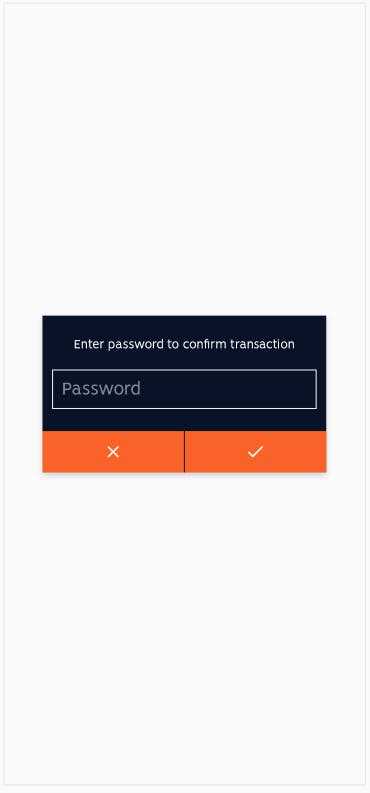

Security of your assets is our first priority. There will be multiple layers of security checks at all important steps which will directly your indirectly make you interact with your funds.

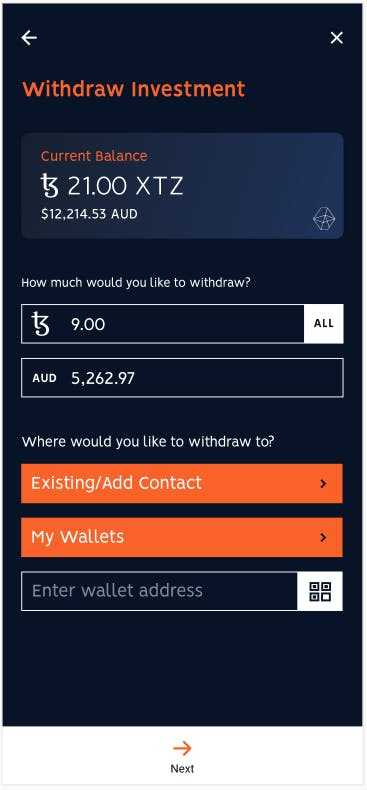

You can withdraw your investments to your existing contacts or to a new wallet address anytime.

Final Thoughts

DeFi aggregators are designed to help investors block out the noise, avoid distractions, and avail the best investment opportunities available in the fragmented, competitive DeFi space. They bring the same security, transparency, and cost-effective trade execution made possible by blockchain technology to users in the palm of their hand, and they allow you to seamlessly control and manage your assets and investments — all from a comprehensive, intuitive, user-friendly interface.

We will update you more about the Unido App soon and discover more about the Unido suite of products here.